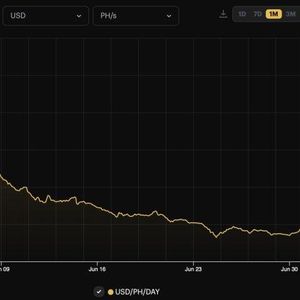

Summary Crypto markets are poised for a potential upward turn. The technical charts of Altcoins look especially explosive. Sentiment in crypto markets have been battered, and are close to September 2022 lows - just before cryptos made a multi-month run higher. When compared to other asset classes and crypto miners, spot cryptos are also at attractive buy points. Crypto markets look ready for a turn higher, at a time when risk sentiment in the space looks battered. Altcoins in particular, look explosive, and could catch the market by surprise. Bitcoin ( BTC-USD ) is turning higher from support. It looks more likely to be settling in a 58k to 73k range, rather than topping out. Daily Chart: Bitcoin TradingView Ethereum ( ETH-USD ) is making the right moves too. It has popped above the cluster of 10 and 20 day moving averages, and if it goes on to take out the 50 day MA (around 3,545 at the time of writing), price would actually be above all its key moving averages - which is a rare development for cryptos now. Daily Chart: Ethereum TradingView I now come to the total crypto market cap excluding Bitcoin and Ethereum - which is a good proxy for altcoins. Altcoins have broken down from a large distribution pattern, which should send them swiftly lower. However, we can actually see them bunching up and consolidating just below the breakdown level. Daily Chart: Crypto Market Cap Excluding Bitcoin and Ethereum TradingView This tells me the market is finding it difficult to go lower, and is running against the expected outcome from a bearish pattern. If it can swiftly reclaim the above the breakdown area, there would be a high probability of a false breakdown, which can lead to a very explosive move higher. This reminds me of silver ( XAGUSD:CUR ) back in July to October 2022, where price similarly broke down from a bearish distribution pattern. We may observe from the chart below that price did not follow through lower, but instead started bunching up and consolidating. When price reclaimed above the key pivot, the false breakdown was confirmed, and price rose swiftly higher. I think there is a good chance we see this play out in the Altcoin space. Weekly Chart: Silver TradingView Ratios of Bitcoin versus other asset classes are also turning higher at supports, as shown below. Daily Chart: Ratio of Bitcoin to Gold TradingView Daily Chart: Ratio of Bitcoin to Commodities TradingView Daily Chart: Ratio of Bitcoin to Treasury Bonds TradingView Daily Chart: Ratio of Bitcoin to S&P500 TradingView All the ratios above reflect a higher chance that we are seeing Bitcoin in a range, rather than topping out. My preferred vehicle to play this space is in spot cryptos. This is because spot cryptos are very attractive relative to crypto miners. From the ratio of Bitcoin to Bitcoin miners ( WGMI ) below, we may observe the ratio starting to turn higher. It has been making a series of higher lows, which supports the likelihood of a turn here. Daily Chart: Ratio of Bitcoin to Bitcoin Miners TradingView When we look at sentiment in the crypto space, sentiment is pretty battered - not surprising, with popular altcoins like Solana ( SOL-USD ) and Dogecoin ( DOGE-USD ) down -30% and -45% from their 52 week highs respectively. The CMC Crypto Fear & Greed index shows that sentiment is pretty close to the September 2022 lows, which is when the crypto market first started running higher. CMC Overall, I think sentiment in the crypto market has reset a great deal, removing a lot of froth and exuberance. Spot cryptos look more likely to be in a range, rather than to be topping out. As they are turning higher from the lower end of their ranges, I think this is an attractive area to go long.